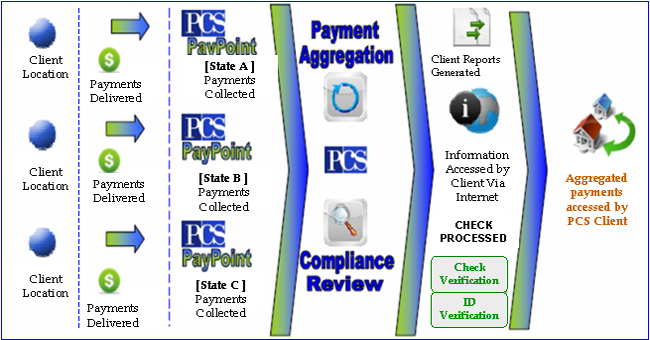

The BEST Card Systems Payment Collection Service is designed for Clients that operate a business which, in whole or in part, offers products or services to the general public through use of branch locations and/or independently owned and operated retail, franchise or agent locations that are contractually obligated to deliver some or all of the money received from the general public to the Client.

The BEST Card Systems Payment Collection Service allows satellite locations of qualified Clients to make deposits of collected payments, at bank branches throughout the United States. The deposits are credited to the Client account, at Client-designated U.S. bank account(s) the following business day.

HOW DOES IT WORK?

Service Features

|

Industry-leading online reporting:Daily and Monthly Reports |

|

State-of-the-Art payment management technology:Interfaced with bank systems for aggregation of payments from all sources throughout the U.S. |

|

Security :Secure, 128-bit encypted, PCI DSS compliant technology |

|

AML Compliance :Risk management and Bank Secrecy Act compliance (anti-money laundering, counter-terrorist financing, anti-fraud, OFAC, KYC) |

|

Added Value/Flexibility :Special arrangements allow Client to make payroll and conduct other functions, as permitted by law |

The BEST Card Systems Advantage

|

Over 5,500 BEST Card Systems PayPoints where payments can be accepted throughout the U.S. |

|

Provides convenient, nationwide access to alternative payment channel - Available in 27 states (and growing) |

|

Cash payments credited to Client accounts the same day |

|

Client can track payments made, by location-by-location, Online |

|

Outsourcing results in streamlined collection management, and less staffing and related overhead |

|

Rapid, secure and cost-effective |

BEST Card Systems Payment Collection Services is intended for use by clients with:

|

Multiple and/or distant locations |

|

Multi-Level Marketing operations |

|

Branch locations |

|

Independently owned/operated retail locations |

|

Franchise locations |

|

Agent locations |

Through use of the BEST Card Systems Collection Service, BEST Card Systems is able to::

|

Process payments that facilitate the payments for services through a clearance and settlement system by agreement with a creditor or seller; |

|

Accept and (if needed) transmit funds only as an integral part of the sale of goods or the provision of services, through a bank that accepts and transmits the funds |

|

Provide a clearance and settlement system and act as intermediary between BSA regulated institutions; i.e. BEST Card Systems is a mere instrumentality that the financial institutions use to process their transfers. |

Every client has an account in their name, with full access, control and management of the funds in that account, and the account his held in an FDIC insured financial institution*. :

|

The client receives checks, in the name of the client (only), into a client bank account. |

|

The client may conduct bill payment from its the bank account. |

|

The client may write checks from its bank account. |

|

The client receives bank statements, in its name. |

BEST Card Systems is not an FDIC insured financial institution. Limitations may apply.